Copper and Stainless Steel Pricing – A Barometer of Industrial Activity?

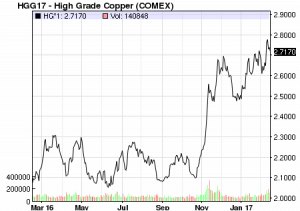

For those of you that follow the copper market, I am certain you have noticed the dramatic move to higher prices that started in late October. As you can see from the 1-year chart below, copper had trended in a band all year long between essentially $2.10 and $2.30, yet has spiked $0.65/lb. higher. This is about 31% higher since the last bottom at $2.10. Clearly, this is a strong move over a relatively short period of time, and it has happened during a period absent of any overwhelmingly strong economic news around the world.

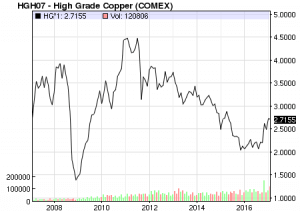

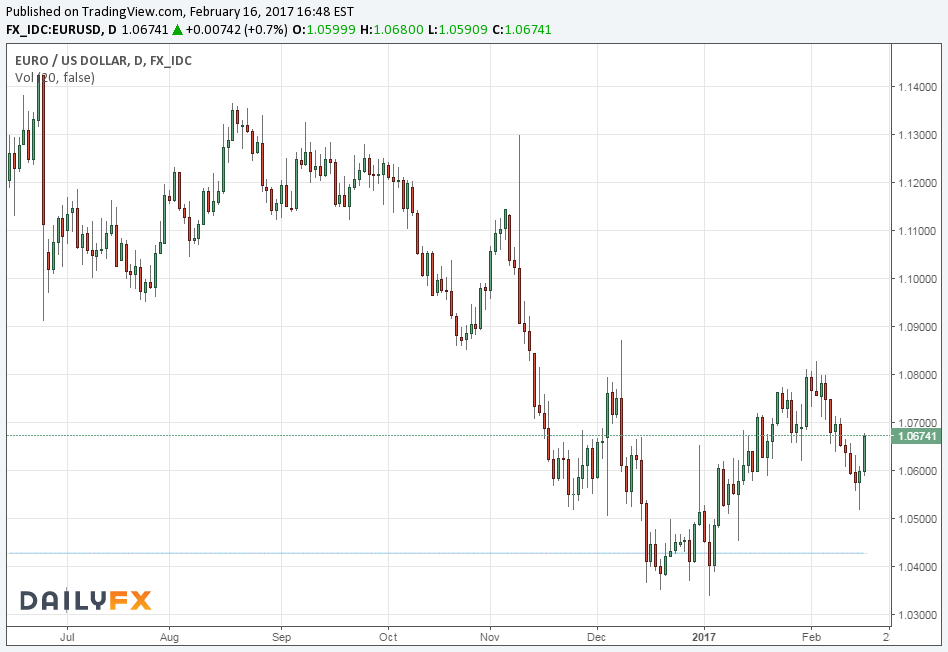

As a dollar traded commodity on the international markets, the price of copper can be influenced by the relative value of the U.S. dollar. However, in this case we see the Dollar has strengthened slightly versus the Euro over the same period, so that leaves us with a simple supply/demand situation driving price. Below I have included the one and ten year charts for copper to provide context, along with the last 6+ months of the Euro/Dollar market.

Copper – One Year

Source: http://www.nasdaq.com/markets/copper.aspx?timeframe=1y

Copper – Ten Year

Source: http://www.nasdaq.com/markets/copper.aspx?timeframe=10y

Euro/Dollar Market – Last Six Months

Source: https://www.dailyfx.com/charts

Source: https://www.dailyfx.com/charts

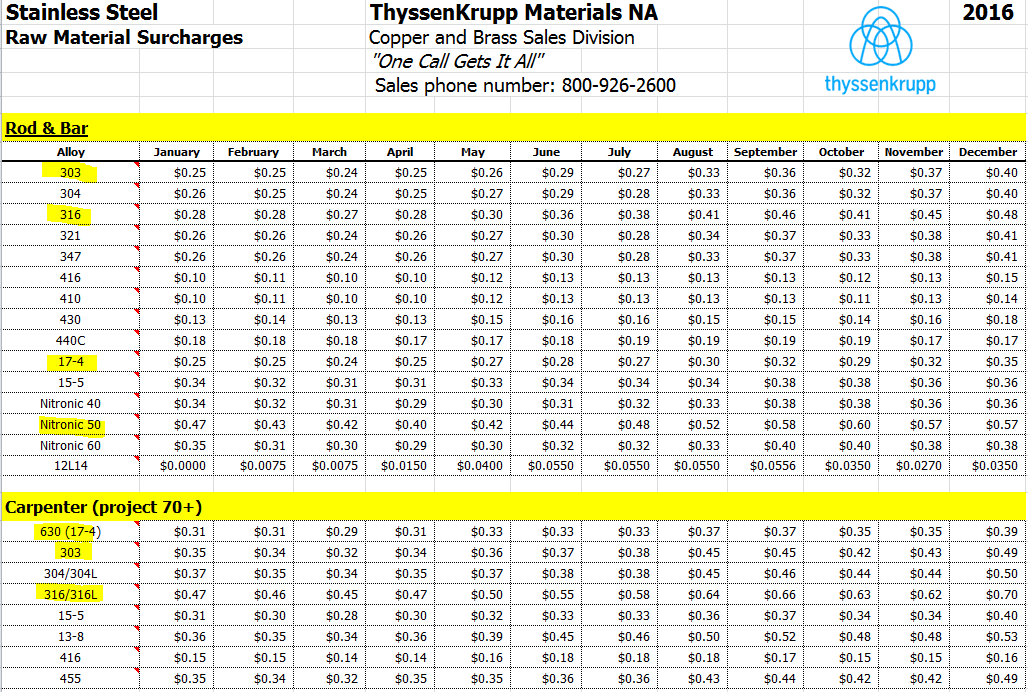

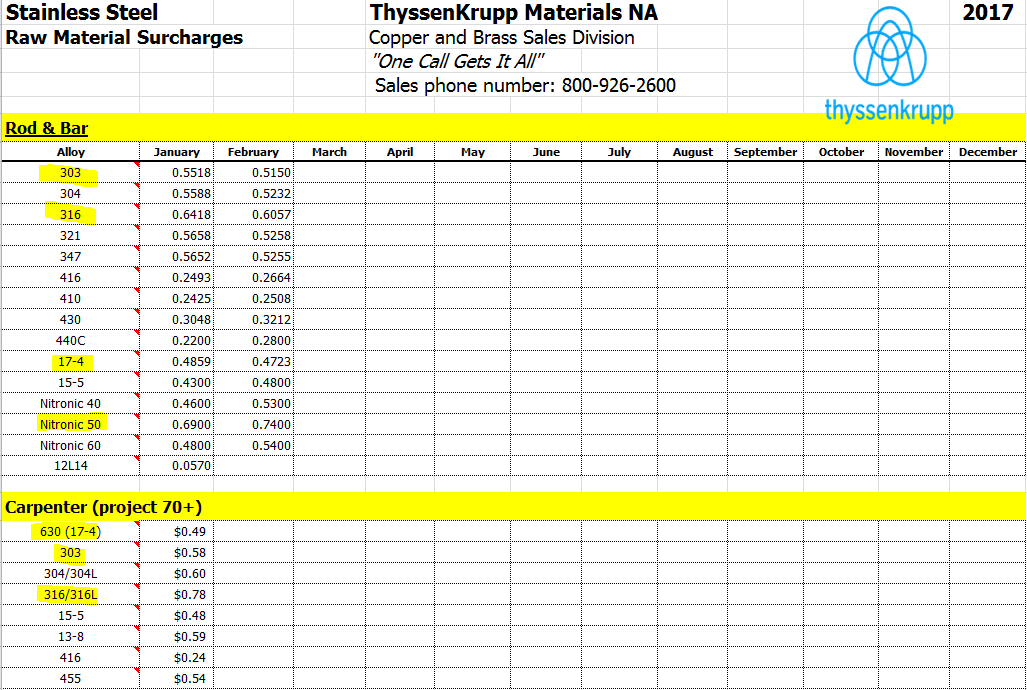

Stainless Steel products have also seen a dramatic increase in the alloy surcharges. I have attached data from ThyssenKrupp from the past 14 months to illustrate the dramatic rise in alloy surcharges. I encourage you to look closely at the Oct/Nov/Dec/Jan/Feb surcharge trends for 303/316/17-4 and Nitronic 50.

Source: ThyssenrKrupp Materials NA

When I overlay the copper and stainless steel price data with our own order entry figures, I see very strong correlation, especially from mid-December. Couple that with observations shared by customers and others industry friends, and I would say that we are in the beginning of what I hope is a prolonged period of economic expansion. If I am correct, what does that mean for all of us? First, it will put upward pressure on raw materials, which will initally impact the contract manufacturers. How they deal with it is another matter. Will they absorb it or do they have pricing power with their customers that allows them to pass it along? Second, a result of this will be less raw material on the distributors’ shelves and pipeline, which will likely lead to shortages. The mills may try to ramp up to replenish stocks, adding further price pressure to the supply/demand charts.

Is this seen as a threat or an opportunity? It depends on how you wish to view it, and what you can do to position yourself to take advantage of the market trends. All I know is that I do not want to get caught short of quality materials. I’ll report back next quarter to see if the trend continues and what other economic forces may be influencing the markets.

Last question, is anyone else asking themselves if there is any correlation with the November election?

Regards,

Mike Reader, President

China Instrument Parts

readerm@machineinstrumentparts.com